A Life Bridging Finance and Social Impact

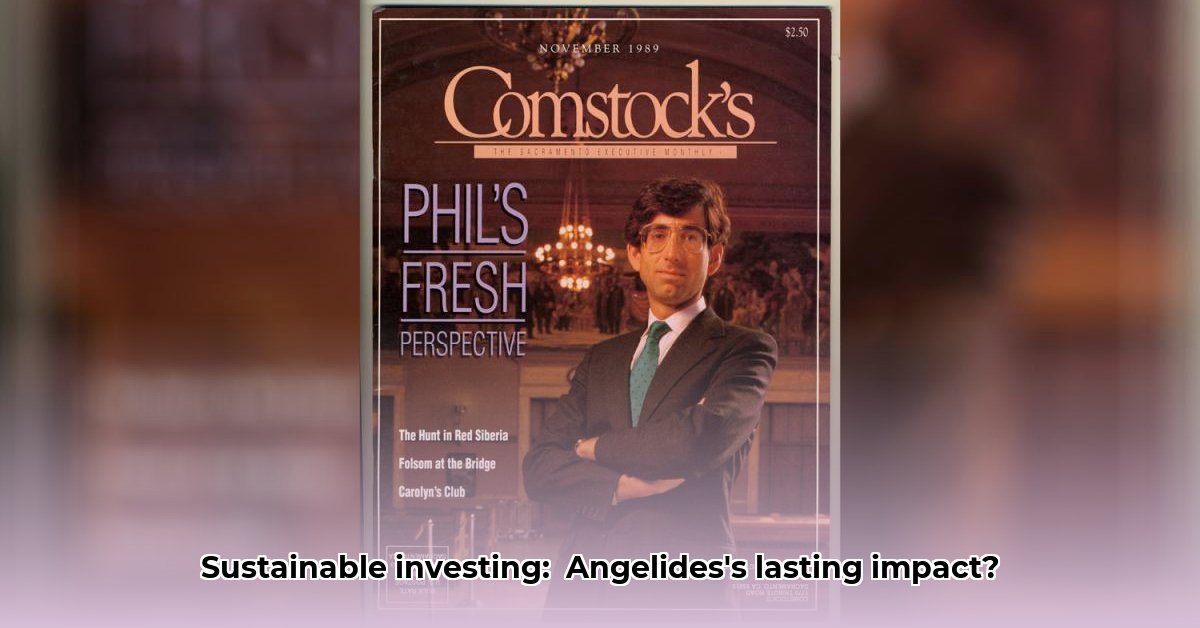

Philip Angelides’ career transcends a simple resume; it's a compelling narrative of a man striving for transformative change across finance and public service. From overseeing California's finances to playing a pivotal role in investigating the 2008 financial crisis, Angelides has consistently sought to align financial success with social responsibility. His journey, however, hasn't been without its challenges, prompting critical examination of his strategies and their long-term impact.

Did Angelides successfully navigate the complex interplay between financial returns and social good? The answer, as we'll explore, is nuanced and requires a detailed analysis of both his successes and shortcomings.

Taking on California's Finances: A Green Vision

As California's State Treasurer, Angelides implemented innovative programs like the Green Wave and Double Bottom Line initiatives. These programs funneled billions of dollars into businesses demonstrating both environmental sustainability and a commitment to underserved communities. This approach represented a bold attempt to prove that profitability and social responsibility are not mutually exclusive. Angelides aimed to create a model of responsible investing that could be replicated elsewhere.

However, this ambitious undertaking faced criticism. Some pointed to losses within California's massive pension funds (CalPERS and CalSTRS), raising questions about the wisdom of prioritizing certain socially responsible investments, particularly when it came to the risk tolerances involved. These losses—though substantial—need to be viewed within the context of a long-term strategy and high-risk, high-reward investments with significant social benefit. Were the short-term financial setbacks outweighed by the potential long-term environmental and social gains? This remains a crucial question demanding continued scrutiny and analysis.

The Aftermath of the 2008 Crisis: A Call for Reform

Angelides’ influence extends far beyond California. His significant contributions to the Financial Crisis Inquiry Commission (FCIC), the official body investigating the 2008 financial meltdown, were instrumental in shaping the commission's final report. This report, offering a detailed analysis of the crisis's causes, significantly influenced subsequent regulatory reforms. His expertise in navigating complex financial issues translated effectively into impactful policy changes. His work on the FCIC showcased his ability to translate intricate financial understanding into practical, systemic improvements.

Measuring Success: Beyond the Numbers

Evaluating Angelides' legacy demands a perspective exceeding simple financial metrics. While some investments didn't yield the anticipated returns, the long-term effects of his socially responsible investing are still evolving. Billions were channeled towards sustainable enterprises and historically marginalized communities. How does one measure the success of initiatives prioritizing people and the planet over immediate profits? This requires a thorough, multi-faceted analysis, combining financial performance data with qualitative assessments of social and environmental impacts. Only then can we effectively determine the return on investment, as well as the societal return.

Furthermore, the long-term impacts of initiatives like the Green Wave and Double Bottom Line are not immediately apparent. Certain positive consequences may not fully materialize until many years after the investment. This necessitates both further research and a broader, longer-term perspective in our evaluation. There are many differing perspectives regarding whether the short-term losses were justified, given the long-term aim of his strategies.

A Lasting Influence: The Ongoing Conversation

Angelides' career exemplifies the challenges and triumphs of championing progressive values within finance and public service. He challenged conventional wisdom and advocated for a vision of sustainable finance that remains relevant today. His journey teaches us valuable lessons about balancing ideals with practical realities in both government and the financial markets. His enduring influence continues to shape discourse on sustainable finance, financial regulation, and the broader definition of success in our intricate world. The examination of his long-term effects is far from over.

How Did Phil Angelides' Investment Strategies Impact California's Pension Funds?

Key Takeaways:

- Angelides directed significant public funds towards sustainable development and clean energy.

- His vision aimed to integrate environmental responsibility with economic growth and social equity.

- A comprehensive evaluation of his financial strategies requires in-depth analysis of both short-term and long-term outcomes.

- His role in the Financial Crisis Inquiry Commission indirectly impacted the stability of California's pension funds.

- Assessing the full impact needs detailed analysis across multiple initiatives.

Angelides' Approach to Sustainable Investing

Angelides' time as Treasurer involved managing substantial public funds. His philosophy emphasized responsible investing, integrating environmental, social, and governance (ESG) factors (environmental, social, and governance considerations in investment decisions). This approach prioritized not only maximizing returns but also aligning investments with broader societal goals. How did this philosophy impact California's pension funds? By prioritizing sustainable development, he directed significant resources towards these sectors. However, did this strategy enhance overall returns? This question requires continued evaluation.

Investing in a Greener Future

A considerable portion of California's pension system funds were invested in clean energy projects under Angelides's leadership. The potential for high returns within a rapidly expanding sector was a primary driver. The long-term success of these investments depends on numerous factors, such as technological advancements and market conditions. Moreover, did the investment process fully take into account the risks associated with venture capital in emerging markets?

Beyond the Balance Sheet: Social Impact

Angelides' strategy extended beyond pure financial gains. His commitment to affordable housing development, resulting in over 100,000 units, demonstrates this holistic approach. However, how did these social considerations influence the overall financial performance of the state's pension systems? Did the social benefits translate into improved returns, or were they distinctly separate objectives?

Navigating the Financial Landscape

Angelides’ leadership extends to broader financial market reforms. His work with the FCIC provided crucial insights into the 2008 crisis, directly informing the risk management strategies in pension fund management. By preventing future crises, his work indirectly enhanced the long-term security of California's pension funds.

Measuring Success: Challenges and Future Directions

Assessing Angelides' influence comprehensively necessitates an in-depth analysis, including both financial performance and societal outcomes. Further research is needed to provide complete data on long-term returns for specific investments. Moreover, are there any lessons learned from initiatives that fell short of expectations? How can future investment strategies learn from both successes and failures? A comprehensive cost-benefit analysis comparing Angelides' initiatives with similar efforts is essential for a fair and accurate evaluation.